SMSF Property Lending Made Simple

Access Australia's most comprehensive panel of SMSF specialist lenders. Get competitive rates, 48-hour pre-approval, and expert guidance every step of the way.

What is SMSF Property Lending?

Self-Managed Super Fund (SMSF) lending allows you to use your superannuation to invest in residential or commercial property. Unlike traditional home loans, SMSF loans require specialist lenders who understand the unique compliance requirements and lending structures.

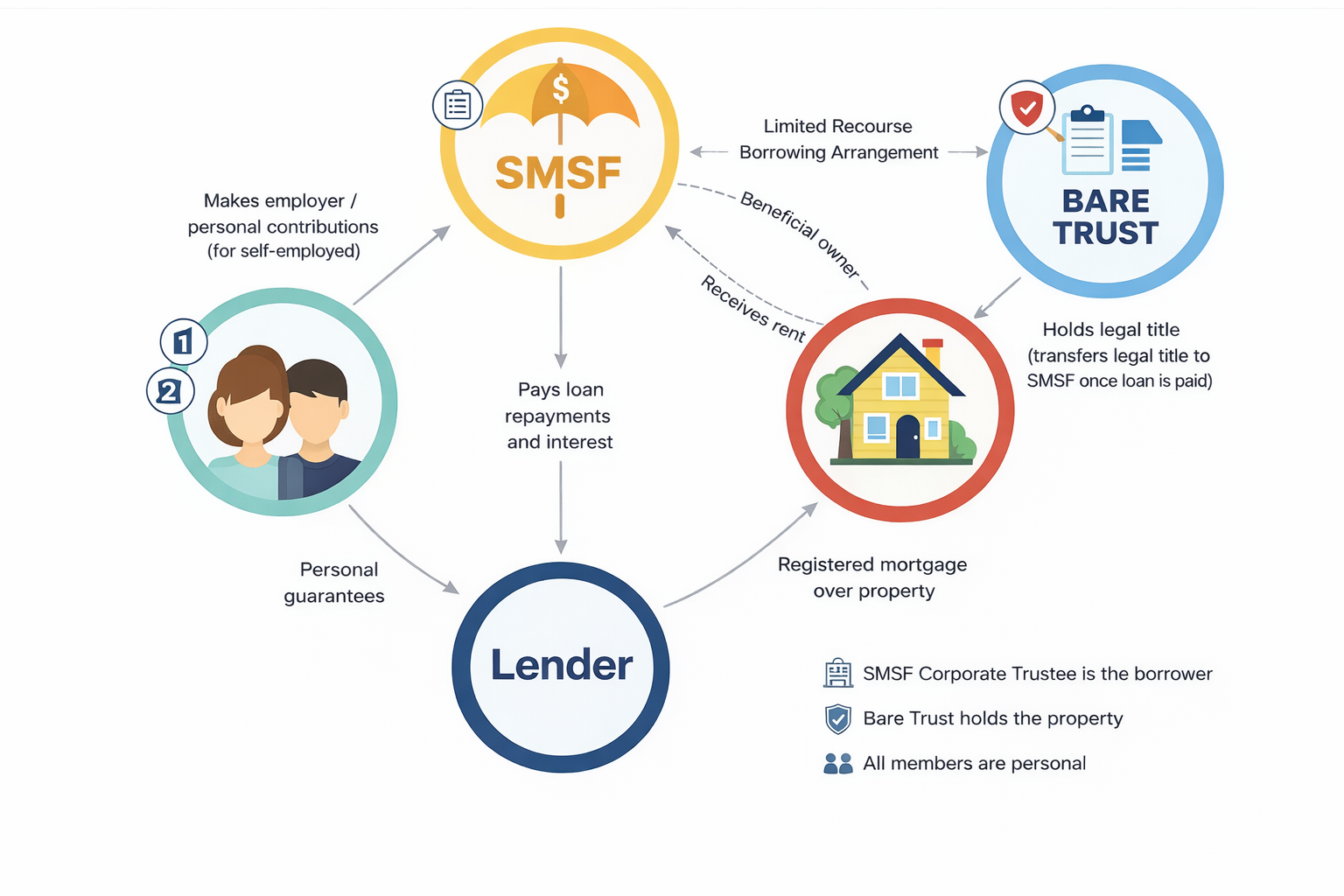

SMSF property loans use a Limited Recourse Borrowing Arrangement (LRBA), which protects your other super assets if something goes wrong. The property is held in a separate trust until the loan is fully repaid.

How a Limited Recourse Borrowing Arrangement (LRBA) protects your SMSF assets

Why Choose SMSF Property Investment?

- Build wealth inside your super with tax advantages

- Diversify your retirement portfolio beyond shares

- Potential for capital growth and rental income

- Greater control over your retirement savings

Why Choose Evolution Lending for Your SMSF Loan?

Fast Pre-Approval

Get pre-approved in 48 hours so you can make offers with confidence. Our streamlined process means you won't miss out on investment opportunities.

20+ Specialist Lenders

Access to a comprehensive panel of SMSF-friendly lenders. More options mean better rates and terms tailored to your situation.

Outcome-Focused

With strong lender partnerships and specialist SMSF knowledge, we help you secure the right structure, terms, and flexibility for your investment strategy.

100% Compliance

Navigate complex SMSF rules with confidence. We ensure your loan structure meets all ATO and ASIC requirements from day one.

Expert Guidance

20+ years of SMSF lending experience. We coordinate with your accountant, financial advisor, and solicitor for seamless settlement.

Flexible Solutions

Residential or commercial. Fixed or variable rates. We find the right loan structure for your investment strategy.

Our Trusted SMSF Lender Partners

We work with Australia's most trusted SMSF lenders to find you competitive rates and terms for your property investment.

Plus access to additional specialist lenders based on your unique requirements. Our extensive panel ensures you get competitive rates and flexible terms. Lender availability subject to eligibility and lending criteria. Not all lenders available for all scenarios.

Your SMSF Property Journey — 4 Simple Steps

Strategy Call (15 Minutes)

Start with clarity.

In a short call, we assess your SMSF position, borrowing capacity, and overall property strategy. You'll walk away knowing what's possible and what needs to be in place.

What we cover:

- Review of your SMSF structure

- Discussion around investment goals

- Estimated borrowing capacity

- Overview of LRBA lending requirements

Example: Think of this as your feasibility check before committing time or money to a property search.

48-Hour Pre-Approval

Know your buying power.

We approach 20+ SMSF lenders and identify the right policy fit for your situation — focusing on structure, flexibility, and long-term suitability.

What you receive:

- Tailored lender comparison

- Negotiated terms

- Written pre-approval

- Clear property search parameters

Now you can make offers with confidence, knowing your numbers stack up.

*In some cases, 48-hour pre-approval may not be possible due to lender requirements or application complexity.

Formal Approval Process

We manage the moving parts.

Once you secure a property, we coordinate the application, valuation, and lender requirements — working alongside your accountant and trustee to ensure everything aligns correctly.

We handle:

- Full application submission

- Valuation coordination

- LRBA documentation requirements

- Formal loan approval

You focus on the investment. We manage the process.

Settlement & Ongoing Support

Beyond the transaction.

We coordinate with your solicitor to ensure a smooth settlement. After that, we remain your SMSF lending partner — supporting reviews, refinances, and future acquisitions.

Ongoing support includes:

- Settlement coordination

- Structural alignment check

- Loan strategy reviews

- Planning for your next purchase

The Outcome

A structured, compliant, and strategically aligned SMSF property purchase — handled step-by-step with clarity and confidence.

Frequently Asked Questions

What is the maximum LVR for SMSF loans?

Most lenders allow:

- Up to 80% LVR for residential property

- Up to 70% LVR for commercial property

However, approval isn't just about the percentage. Lenders also assess:

- SMSF cash position after purchase

- Rental income coverage

- Member contribution history

- Property type and location

Example: If your SMSF has $300,000 in cash and wants to buy a $800,000 residential property, you may qualify for 80% lending but the lender will also check that enough liquidity remains in the fund after settlement.

The right structure matters more than simply pushing to the highest LVR.

What are typical SMSF loan interest rates?

SMSF loans are generally priced slightly higher than standard home loans due to their structure and regulatory requirements.

Rates typically vary depending on:

- Residential vs commercial property

- Loan size

- LVR

- Strength of the SMSF financial position

Rather than focusing only on rate, we look at:

- Policy flexibility

- Liquidity requirements

- Ongoing contribution strategy

- Exit options

In SMSF lending, structure and sustainability are more important than chasing the lowest rate.

Can I use my SMSF to buy a property I'll live in (residential)?

No. SMSF property must meet the sole purpose test under superannuation law.

This means:

- You cannot live in it

- Family members cannot rent it

- It must be leased at market rates to unrelated tenants

A simple rule: if you personally benefit from using the property, it's not compliant.

Can I use my SMSF to buy a commercial property and lease it to my own business?

Yes — this is permitted, provided it is structured correctly.

Under superannuation law, the investment must still meet the sole purpose test, meaning the property must be held purely to provide retirement benefits to fund members.

Here's how it works:

- The property must be a genuine commercial property (not residential)

- It must be leased under a formal lease agreement

- The rent must be at market rates

- Rent must be paid on time and documented properly

Unlike residential property (which cannot be rented to members or related parties), commercial property can be leased to your own business as long as everything is done at arm's length.

Simple rule: If it's commercial property and the lease terms reflect true market conditions, leasing it to your business is allowed. If it's residential, it cannot be used by you, your family, or related parties.

This strategy is commonly used by business owners who want their super fund to own their business premises while building retirement wealth.

What is a Limited Recourse Borrowing Arrangement (LRBA)?

An LRBA is the legal structure that allows an SMSF to borrow to purchase property.

Key points:

- The property is held in a separate holding (bare) trust

- The SMSF is the beneficial owner

- Loan repayments are made from the SMSF

- If the loan defaults, the lender's claim is limited to that property only

Think of it as a protective structure — isolating the asset and protecting the rest of the fund.

Getting this structure correct from the beginning is critical.

How long does SMSF loan approval take?

Typical timeframes:

- Initial assessment: 15-minute strategy call

- Pre-approval: Within 48 hours (In some cases, 48-hour pre-approval may not be possible due to lender requirements or application complexity)

- Formal approval: 2–4 weeks (In some cases, approval may take longer due to lender requirements or application complexity)

- Settlement: Usually 6–8 weeks from contract

Delays typically occur when:

- Trust deeds are outdated

- Financials are incomplete

- Outdated bank/loan statements

- Liquidity requirements are not properly planned

Preparation is what keeps the timeline smooth.

Do I need an SMSF accountant?

Yes. An SMSF requires ongoing professional oversight.

Your accountant and auditor will:

- Prepare annual financial statements

- Lodge SMSF tax returns

- Ensure ATO compliance

- Manage contribution and pension reporting

We work alongside your accountant to ensure the lending structure aligns correctly — but ongoing compliance remains with the SMSF trustees.

The Key Takeaway

SMSF property lending is not just about getting approved. It's about structuring correctly, maintaining compliance, and ensuring the investment supports your long-term retirement strategy.

Ready to Build Wealth Through Your SMSF?

Get your free SMSF Property Investment Guide and discover how to leverage your super for property investment.