LRBA Explained

Limited Recourse Borrowing Arrangements — plain English, no jargon.

Everything you need to understand how SMSF borrowing works, what lenders actually check, and what compliance really means in practice.

What is a Limited Recourse Borrowing Arrangement?

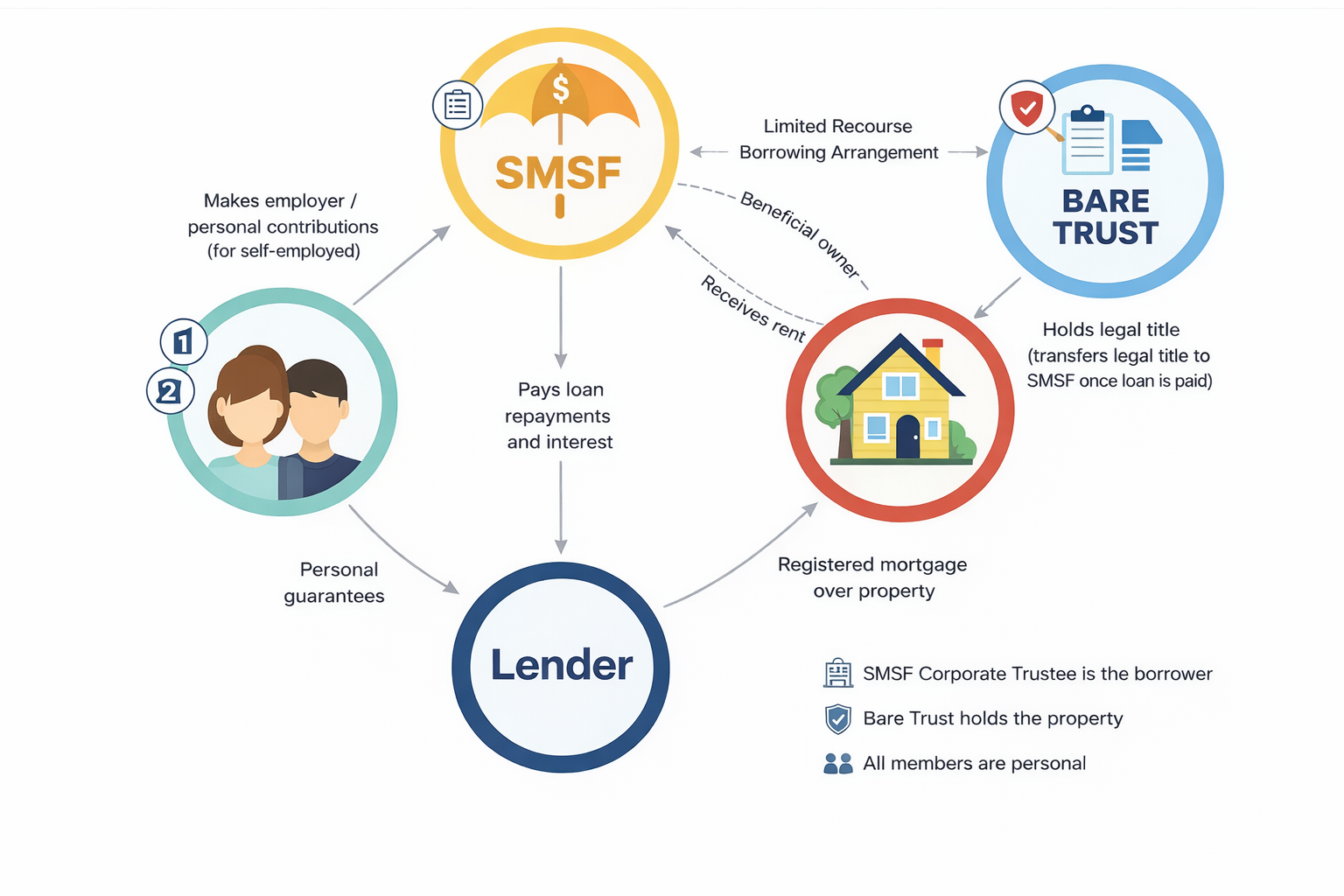

A Limited Recourse Borrowing Arrangement (LRBA) is the legal structure that allows a Self-Managed Super Fund (SMSF) to borrow money to purchase an asset — most commonly residential or commercial property.

The "limited recourse" part is the key. It means that if the loan defaults, the lender's claim is limited to the asset being purchased — they cannot come after the other assets held inside your SMSF. Your broader super savings are protected.

Think of it as a firewall between the property being purchased and everything else in your fund.

In plain English:

Your SMSF borrows to buy a property. That property sits in a separate holding trust. Your SMSF makes the loan repayments. Once the loan is paid off, the property transfers into the SMSF. If something goes wrong before then, the lender can only take the property — not your other super assets.

How an LRBA Works — Step by Step

Your SMSF identifies a property to purchase

Residential or commercial. The property must meet the SMSF's investment strategy and comply with the sole purpose test.

A bare (holding) trust is established

A separate legal entity — the bare trust — holds the property on behalf of the SMSF during the loan term. This is a critical compliance requirement.

The SMSF borrows from a specialist lender

Not all lenders offer SMSF loans. You need a specialist who understands the LRBA structure and ATO requirements.

Loan repayments are made from the SMSF

Repayments come from the fund's cash — contributions, rental income, or other fund income. The SMSF is the beneficial owner throughout.

On full repayment, title transfers to the SMSF

Once the loan is paid off, the bare trust is wound up and the property is transferred directly into the SMSF's name.

How the LRBA structure separates the property from the rest of your SMSF assets

What Lenders Actually Check

SMSF lending is more complex than a standard home loan. Lenders assess both the fund and the deal. Here's what they look at:

Fund Requirements

- ✓ Minimum fund balance (typically $150,000–$200,000+)

- ✓ Up-to-date trust deed that allows borrowing

- ✓ Written investment strategy that includes property

- ✓ 2 years of audited SMSF financial statements

- ✓ Liquidity buffer post-settlement (typically 10%+ of fund)

Servicing Requirements

- ✓ Contributions assessed at 80% (shaded income)

- ✓ Rental income assessed at 80%

- ✓ Stress-tested at rate + 2–3% buffer

- ✓ 30-year P&I repayment basis

- ✓ SMSF running expenses factored in

Property Requirements

- ✓ Maximum LVR typically 70–80% (residential)

- ✓ Standard residential property preferred

- ✓ No off-the-plan, rural, or high-density restrictions

- ✓ Must be a single acquirable asset

Structure Requirements

- ✓ Bare trust deed correctly established

- ✓ Corporate trustee for the SMSF (preferred)

- ✓ Separate bank account for the SMSF

- ✓ Loan in the name of the trustee, not members

Common reason deals fall over:

An outdated trust deed that doesn't allow borrowing, or a fund balance that looks sufficient but doesn't leave enough liquidity after settlement. Both are fixable — but only if caught early.

What Compliance Actually Means

"Compliance" in SMSF lending isn't just a box-ticking exercise. The ATO and ASIC have strict rules around how SMSF borrowing must be structured, and getting it wrong can have serious consequences — including the loan being unwound or the fund losing its complying status.

Sole Purpose Test

The property must be purchased solely to provide retirement benefits to members. You cannot buy a property your members (or related parties) live in or use personally.

Single Acquirable Asset Rule

Each LRBA can only cover one asset. You can't bundle multiple properties into one loan. Each property needs its own bare trust and loan structure.

No Improvements During Loan Term

You cannot make improvements to the property while the LRBA is in place that change its fundamental character. Repairs and maintenance are fine — structural changes are not.

Related Party Transactions

Strict rules apply to transactions between the SMSF and related parties. Renting to a related party is generally not permitted for residential property.

Annual Audit Requirement

Your SMSF must be audited annually by an approved SMSF auditor. The LRBA structure and loan repayments will be reviewed as part of this audit.

How Evolution Lending Partners Can Help

LRBA lending is not something you want to navigate alone. The structure is complex, lender requirements vary significantly, and the compliance stakes are high. Here's where we add value:

Pre-Deal Structuring

We review your fund before you make an offer — checking trust deed, fund balance, liquidity, and servicing capacity. No surprises after contracts are signed.

20+ Specialist Lenders

We work with Australia's most comprehensive panel of SMSF-friendly lenders. More options means better rates and a higher chance of approval for complex scenarios.

Professional Coordination

We work alongside your SMSF accountant, financial adviser, and solicitor to ensure the bare trust, loan documents, and compliance requirements are all aligned.

48-Hour Pre-Approval

When you find the right property, speed matters. Our streamlined process means you can make offers with confidence, not uncertainty.

Official ATO Guidance

The ATO provides the definitive official overview of Limited Recourse Borrowing Arrangements for SMSFs, including examples, conditions, and compliance requirements. For full official guidance, see the ATO's resource below.

ATO — About Limited Recourse Borrowing Arrangements →This page provides general information only and does not constitute financial or legal advice. Always seek advice from a qualified professional before making decisions about your SMSF.

Ready to explore SMSF property lending?

Use our free calculator to get an indicative result in under 2 minutes, or book a free consultation with our SMSF lending specialists.